In the world of finance, your creditworthiness is often measured by a numerical value known as a CIBIL score. CIBIL, which stands for Credit Information Bureau (India) Limited, is a premier credit bureau in India that assesses and maintains credit records of individuals. A CIBIL score is a crucial factor that lenders consider when evaluating your eligibility for loans, credit cards, and other financial products. This comprehensive guide will delve into the intricacies of a CIBIL score, and its importance, and provide five effective strategies to build and maintain a good CIBIL score.

Also Read: With Windows 11, how to copy text from screenshots 11 Method

What is a CIBIL Score?

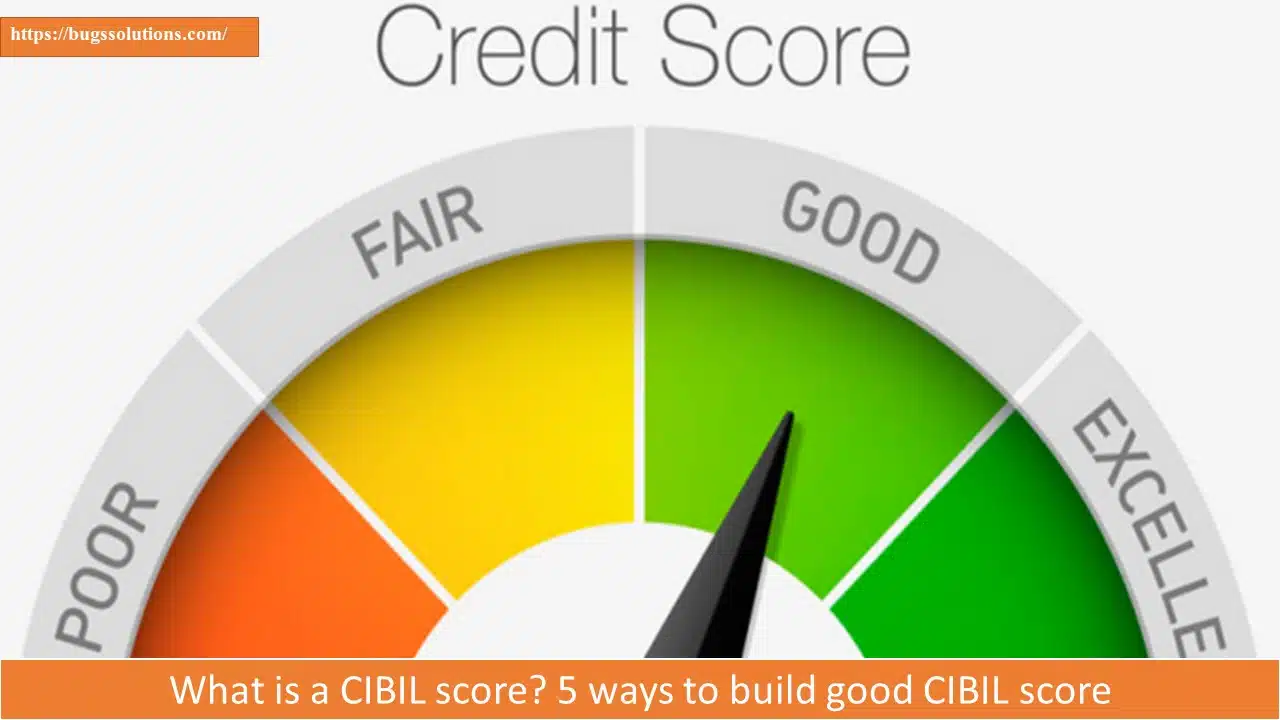

A CIBIL score, often referred to as a credit score, is a three-digit numerical representation of your creditworthiness. This score, ranging from 300 to 900, is calculated based on your credit history and how you manage credit. A higher score implies better creditworthiness, making it easier for you to access credit on favorable terms.

Here’s a breakdown of the score ranges:

- 300-549: Poor

- 550-649: Fair

- 650-749: Good

- 750-900: Excellent

The Importance of a Good CIBIL Score

A high CIBIL score is more than just a number; it has important financial implications:

1. Loan Approvals:

Your CIBIL score is a key factor that lenders, such banks and financial institutions, consider when determining the risk of lending you money. With a higher score, you have a greater chance of getting your loan approved and you may be able to bargain for better conditions and interest rates.

- Rates of Interest

Reduced interest rates on loans and credit cards are possible with a high CIBIL score. This implies that you’ll pay less interest overall, which could result in significant financial savings for you.

- Acceptance of Credit Cards:

Your CIBIL score is another factor that credit card providers use when deciding whether to approve your application. Your ability to obtain premium credit cards with alluring bonuses and incentives depends on your credit score.

Such conditions.

- Rental Contracts:

When evaluating rental applications, landlords could look at your CIBIL score. Your chances of getting a rental home can increase if your score is favorable.

- Career Possibilities:

As part of the recruiting process, some companies, particularly those in the financial industry, may check your credit history. A high CIBIL score may be helpful in these circumstances.

How to Build a Good CIBIL Score

The gradual process of improving one’s CIBIL score necessitates sound financial management. Here are five practical methods to help you raise and keep a high credit score:

Paying bills on time:

1. Timely Bill Payments:

Your payment history is one of the most important variables determining your CIBIL score. Make sure to meet all of your financial commitments, including loan EMIs and credit card bills, on time. Your credit score can suffer greatly from late payments.

- Continue to use little credit:

Credit usage is the amount of your credit limit that you are currently using. Maintain credit card balances that are significantly lower than the credit limit, ideally lower than 30%. Your score may suffer if you have a high credit usage rate.

- A diverse mix of credit:

Different kinds of credit accounts, including credit cards, personal loans, mortgages, and vehicle loans, can boost your credit score. Take on credit, though, only that you can handle properly.

- Limit new credit application requests:

Your credit report undergoes a rigorous inquiry each time you apply for a new credit card or loan. A string of difficult questions in a short period of time may impact your score. Carefully apply for fresh credit.

- Regularly review your credit report:

Check for problems or inaccuracies in your credit report at least once a year. If you discover any errors, report them to the credit bureau to have them swiftly fixed.

Conclusion

In conclusion, your CIBIL score is an essential part of your financial profile and affects both your ability to obtain credit and the terms that are presented to you. Building and maintaining a high CIBIL score is a continuous process requiring sound money management and credit management. You may build and maintain a high CIBIL score by making on-time payments, controlling credit utilisation, diversifying your credit portfolio, avoiding making too many new credit inquiries, and keeping an eye on your credit report. As a result, better financial prospects will become available to you, ensuring your long-term financial security. Keep in mind that having high credit is a precious asset that results in reduced interest rates and more financial flexibility.